Alpha Homora adds leveraged yield farming for ETH/REN and ETH/UMA pools on SushiSwap & UI Improvement

Last week, we launched support for oracle players (LINK, BAND), lending protocols (COMP, AAVE), and Synthetix pools (SNX, sUSD) by adding leveraged yield farming pools with their tokens.

Today, we welcome the Ren and UMA communities to Alpha Homora, as we have added ETH/REN and ETH/UMA leveraged yield farming pools that are on SushiSwap.

- ETH/REN pool with 1.75x leverage

- ETH/UMA pool with 1.75x leverage

So what do leveraged yield farmers gain?

- Earn ALPHA as a part of Alpha Homora Liquidity Mining (2A) program 💥

- Automatically stake SLP token for you on SushiSwap, so you can earn SUSHI

- Earn SUSHI on leverage

- SUSHI earned is automatically reinvested and added to your yield farming position

- Earn trading fees on leverage for providing liquidity to pools

- Can farm with just one token (e.g. no need to have both ETH and REN for ETH/REN or UMA for ETH/UMA pool)

We will automatically and optimally swap roughly half of your supplied token to another token, so you can provide liquidity to the pool on Sushiswap to get a share of trading fees and get SLP token

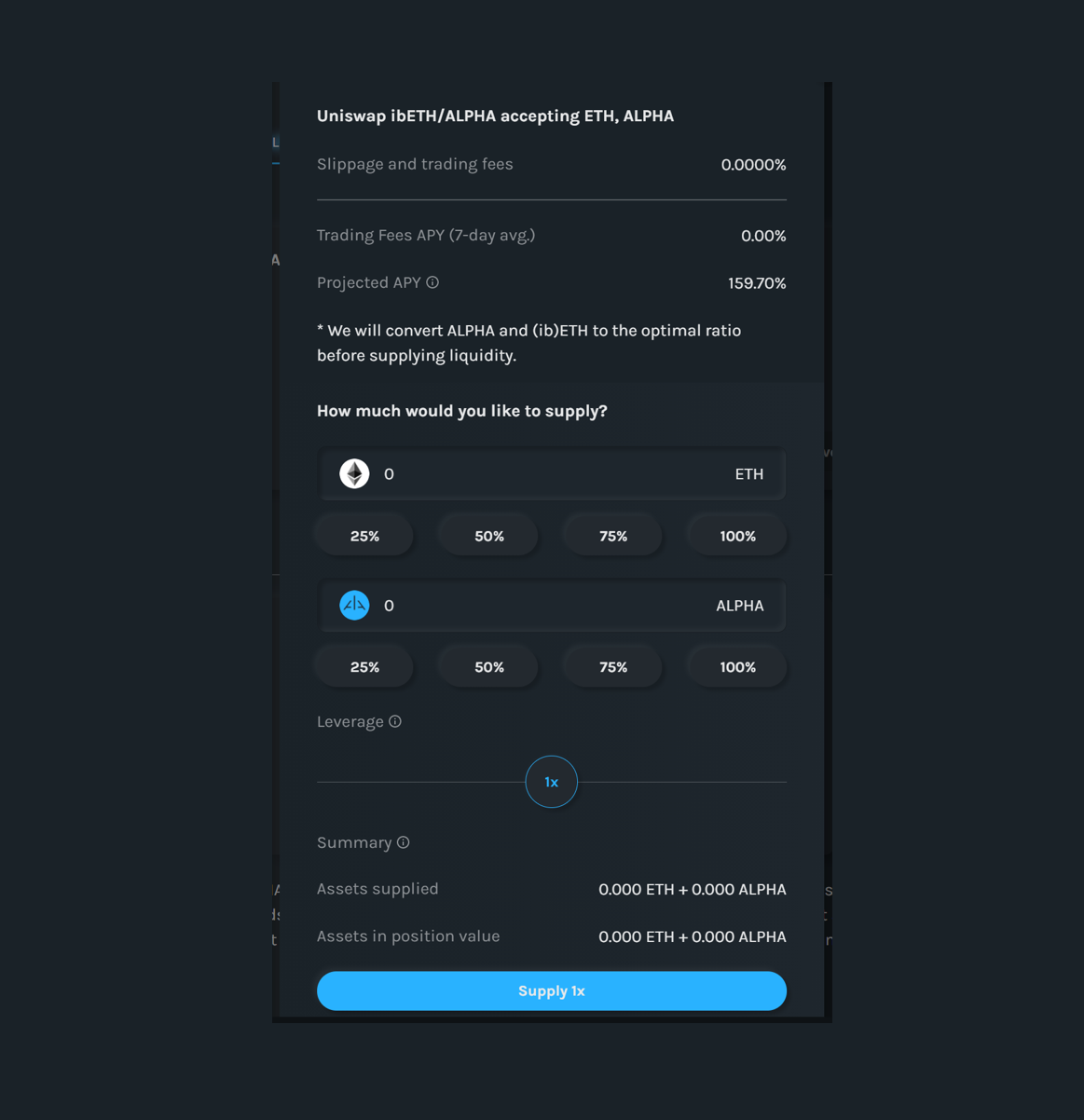

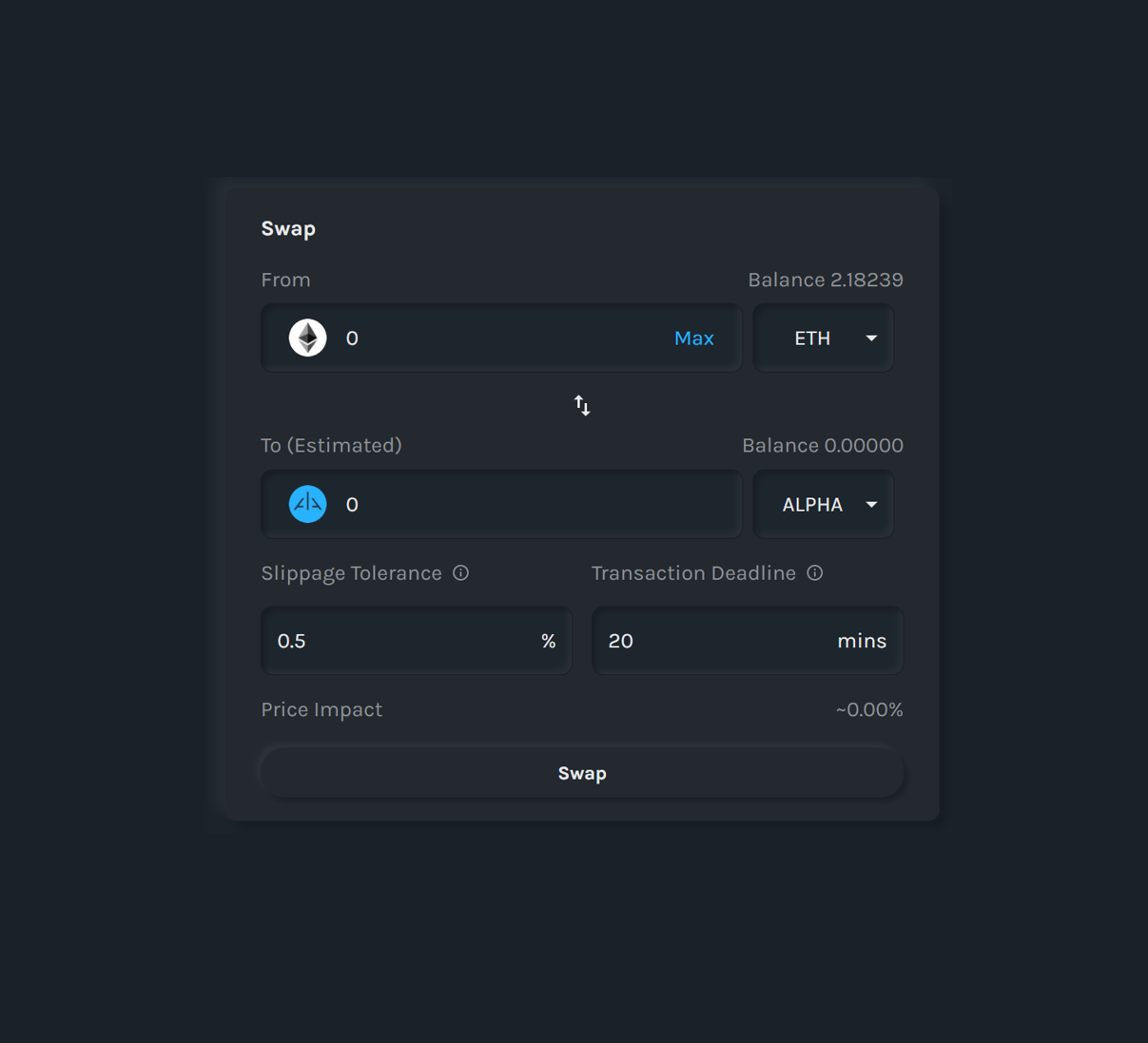

UI Improvement

Apart from adding ETH/REN and ETH/UMA leveraged yield farming pools, we have also took the comments from our community and improved Alpha Homora UI for better user experience!

👉 Firstly, a summary of assets breakdown. Because Alpha Homora will automatically and optimally swap the tokens supplied or ETH borrowed to make sure you have roughly equal value of both assets to provide to liquidity pool, the assets breakdown will give clarity in your position value!

👉 Secondly, slippage control in the Swap page! This function will allow you to set a maximum cap of slippage that you are acceptable with when you swap between ETH (or ibETH) to and from ALPHA.

For detailed step-by-step on how to farm, see here.

About Alpha Finance Lab

Alpha Finance Lab is an ecosystem of cross-chain DeFi products that will interoperate to bring optimal alpha returns to users. Alpha products focus on capturing unaddressed demand in DeFi in an innovative and user friendly way.

We are moving at a rapid pace, so we encourage everyone to join our Telegram / Discord for the latest updates, follow us on Twitter, or read more about us on our Blog!